Free Shiping

On most orders

Bitcoin Accepted

On most orders

Support 24/7

Online 24 hours

100% Safe

Secure shopping

Barista

Mini Express Lichtenstein

Portable Electric Espresso Machine

Nespresso Vertuo Espresso Machine

Breville BES870XL Espresso Machine

PHILIPS 3200 Espresso Machine

Automatic Espresso Machine by Affetto

Classic Stovetop Espresso Maker

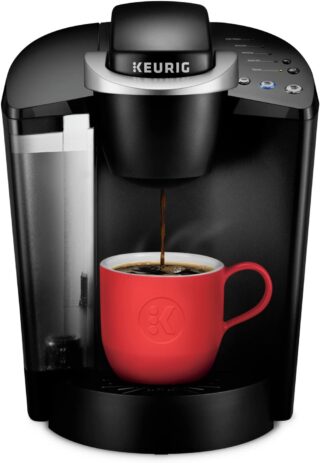

Keurig K-Classic Coffee Maker

Featured

Our Shop

Double Wall Glasses Coffee Cups

Toilet Poop Stool Squatty Potty

Rated 4.75 out of 5 based on 4 customer ratings

Jump Starter 2000A Peak Portable Battery

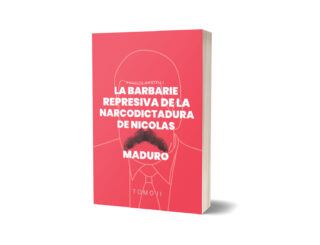

La Barbarie Represiva de la Narcodictadura de Nicolás Maduro II

Canon EOS 2000D Rebel T7 DSLR Camera

Biblioteca

La Barbarie Represiva de la Narcodictadura de Nicolás Maduro II$28.99 Original price was: $28.99.$23.99Current price is: $23.99.

Las cenizas del Ejército Libertador$47.00 Original price was: $47.00.$32.99Current price is: $32.99.

Los Indígenas en el Socialismo del Siglo XXI$32.99 Original price was: $32.99.$27.99Current price is: $27.99.

Política explicada para Millennials: Gens XYZ y próximas generaciones$28.99 Original price was: $28.99.$17.99Current price is: $17.99.

La Hemeroteca Loca VI$8.99 Original price was: $8.99.$6.99Current price is: $6.99.

La Hemeroteca Loca V$7.99 Original price was: $7.99.$5.99Current price is: $5.99.

La Hemeroteca Loca IV$14.99 Original price was: $14.99.$9.99Current price is: $9.99.

Historia de los Primeros Periódicos de América Latina$12.00 Original price was: $12.00.$9.78Current price is: $9.78.

Entre Sueños$9.88 Original price was: $9.88.$7.89Current price is: $7.89.

Morir en el Socialismo del Siglo XXI: Tomo V$25.99 Original price was: $25.99.$17.99Current price is: $17.99.

Morir en el Socialismo del Siglo XXI: Tomo IV$25.99 Original price was: $25.99.$19.99Current price is: $19.99.

Morir en el Socialismo del Siglo XXI Tomo III$17.99 Original price was: $17.99.$10.73Current price is: $10.73.

Morir en el Socialismo del Siglo XXI Tomo I$25.99 Original price was: $25.99.$17.99Current price is: $17.99.

Grandes Intérpretes del Bolero$57.80 Original price was: $57.80.$48.99Current price is: $48.99.

Colección La Guerra del Dictador Hugo Chavez: Contra Comunicadores Sociales y Medios$84.00 Original price was: $84.00.$68.50Current price is: $68.50.

Morir en el Socialismo del Siglo XXI: Tomo II$28.99 Original price was: $28.99.$13.99Current price is: $13.99.

El Asesinato del Capitán de Corbeta Rafael Acosta Arévalo$28.99 Original price was: $28.99.$17.99Current price is: $17.99.

La Guerra del dictador Hugo Chavez contra los Medios en el 2007$13.99 Original price was: $13.99.$10.50Current price is: $10.50.

Noche y Otros Poemas Breves$9.40 Original price was: $9.40.$7.77Current price is: $7.77.

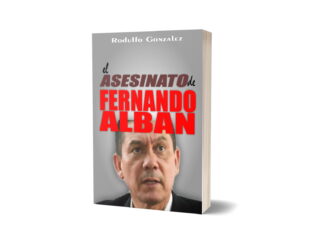

El Asesinato de Fernando Alban$28.99 Original price was: $28.99.$17.99Current price is: $17.99.